In today’s rapidly evolving world of advertising, one term that’s been making quite a buzz is retail media networks (RMNs). With a staggering market value of $45 billion that’s rapidly growing, retail media networks have become an essential tool in the arsenal of advertisers and retailers.

As the advertising landscape undergoes a profound transformation, retail media networks have risen to prominence, offering unprecedented access to valuable first-party data and the means to deliver hyper-targeted advertising to audiences already poised for purchase.

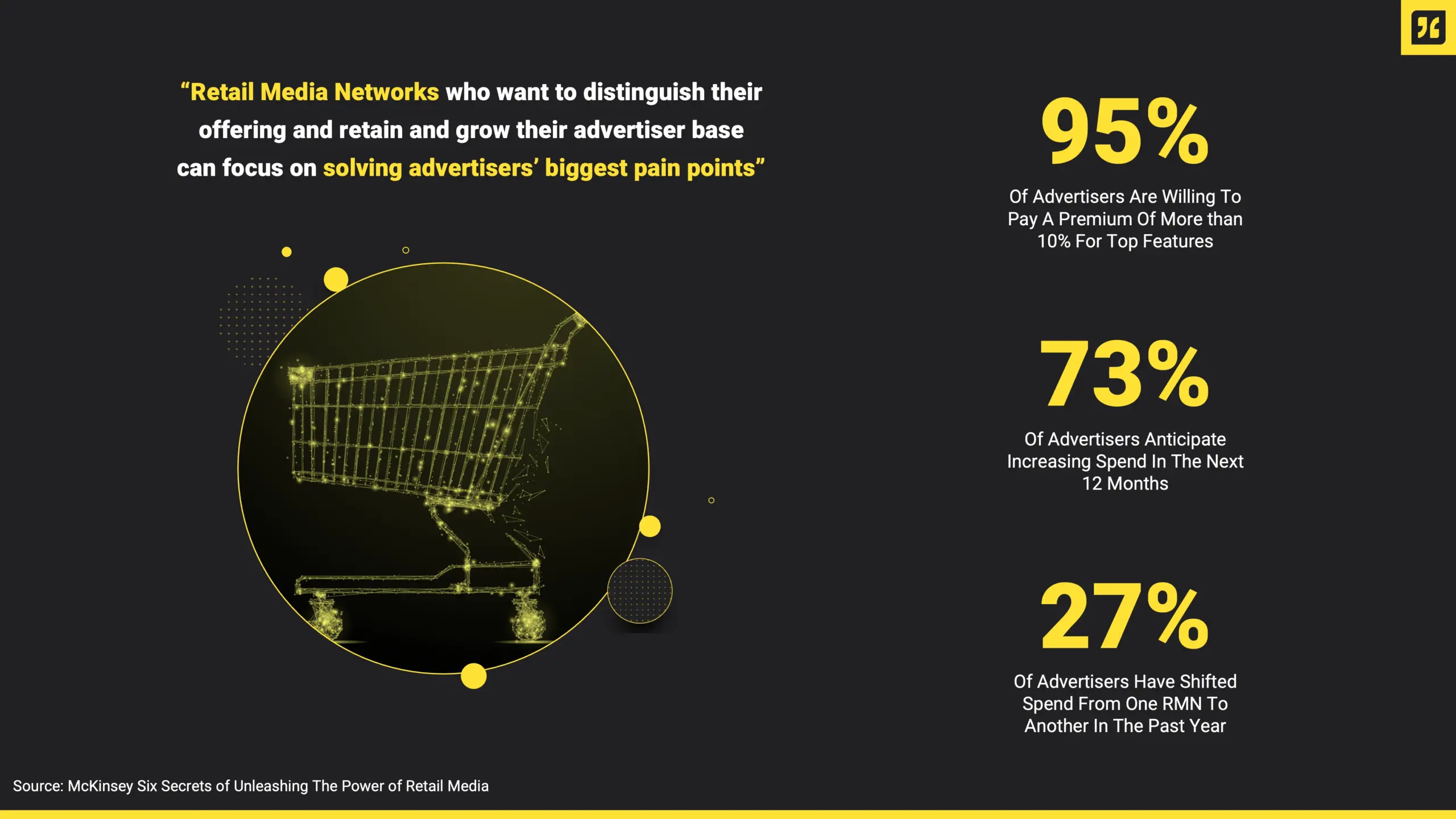

However, the realm of retail media networks is not without its complexities. The abundance of retail media networks and fierce competition can leave brands at a crossroads, seeking guidance on how to effectively initiate and navigate their media network strategies.

In this blog, we’ll define retail media networks, discuss the benefits and challenges, and help guide you through the finer points of choosing one.

Table of Contents:

- What Is a Retail Media Network?

- How Does a Retail Media Network Operate?

- What Are The Benefits of Retail Media Networks?

- What Are The Challenges of Retail Media Networks

- How to Choose a Retail Media Network For Media Partnerships

- What Is a Data Clean Room, and How Does It Relate To Retail Media Networks?

- Navigating The RMN Landscape

- Frequently Asked Questions

What Is a Retail Media Network?

A whopping 62% of companies cited they use retail media networks to access a retailers’ first-party data.

Retail media networks are the in-store promotion stands of the digital age, allowing brands to showcase their ads to you while you virtually aisle-browse. They do this by running off of a retailers’ first-party data — think of it as the subtle notes a shopkeeper jots down about your favorite purchases, preferences, and behaviors. This direct-from-consumer info is the VIP pass for advertisers who often don’t have that level of detail about the customers and their buying journeys.

With internet cookies being phased out for privacy reasons, first-party data is like gold in an advertiser’s pocket. It’s all privacy-compliant because consumers opted into sharing their information willingly, typically through loyalty programs or shopping apps. Retail media networks are poised to lead the ad world into this cookie-less, brave new world, turning first-party data into personalized ad experiences without invading privacy.

Retail-owned networks (like Walmart) leverage in-store data for digital ads, while e-commerce giants (like Amazon) use massive online traffic insights. Niche networks target specific audiences with tailored interests, like Wayfair for home goods, whereas connected networks bridge various platforms, expanding ad reach across the digital landscape.

How Does a Retail Media Network Operate?

Understanding the mechanics of retail media networks can illuminate how modern e-commerce intertwines targeted advertising with shopping experiences to boost sales and enhance customer engagement.

Creating a retail media network begins with a retailer amassing first-party data, like customer purchase history and browsing behaviors, which is pivotal for pinpointing and delivering personalized ads. Next, they need substantial web traffic and sophisticated infrastructure capable of real-time ad serving and detailed analytics. This groundwork allows the retailer to invite advertisers onto their retail media network, where they can craft ads that customers will see as they search and shop online, increasing the likelihood of adding items to their carts.

When a shopper completes a purchase, the retailer benefits from both the product sale and the ad revenue. They deduct their portion from the sales and charge for the ad space. If the retailer isn’t in charge of fulfillment, the advertiser dispatches the product and receives their share post fees. Advertisers then access comprehensive analytics provided by the retail media network, offering invaluable insights into campaign performance and enabling them to fine-tune future ad placements and strategies for better returns.

What Are The Benefits of Retail Media Networks?

Retail media networks stand at the intersection of commerce and advertising, with three key players: the network owners (retailers), the collaborators (advertisers/ media buyers), and the end consumers.

For owners, retail media networks are a lucrative new revenue stream. Take Walmart’s Q3 2021 report, boasting a 240% surge in ad revenue, which can offset the need for price hikes by providing profits from another source.

Advertisers and media buyers get the golden ticket of first-party data, outshining third-party crumbs like cookies. They place ads where consumers’ wallets are already open at the perfect juncture for conversion — one click away. Plus, the same platform that displays their ads tallies the sales, offering a clear view of the ad’s impact.

Consumers, the linchpin of this model, benefit from steadier prices, as retailers balance profit margins with ad income. Moreover, they enjoy a cleaner, more tailored shopping experience. The ads they see are relevant and less intrusive, enhancing their online journey rather than disrupting it.

What Are The Challenges of Retail Media Networks?

Retail media networks are reshaping the advertising landscape but not without challenges. A key issue is that offers through retail media networks are targeted based on consumer behavior, not personalized to individual preferences. The distinction is critical: targeted offers are based on group data and trends, whereas personalized ones are tailored to the individual, potentially making the former feel less relevant and more like generic ad noise.

Additionally, consumers must contend with ads in their shopping experience, which can be intrusive and detract from the user experience, especially if the ads are not well-aligned with their interests.

For smaller brands, the ascent of retail media networks can seem daunting. Giants like Amazon wield immense power through their retail media networks, deepening the divide for smaller players lacking the traffic or resources to compete in this arena.

The novelty of retail media networks also presents a steep learning curve for many companies. They must navigate this evolving space without the benefit of established best practices, often learning through trial and error.

Lastly, the diversity of retail media networks leads to fragmented data ecosystems. The ‘walled garden’ nature of these networks can prevent a holistic view of customer behavior across platforms, hampering effective cross-platform advertising strategies and leaving brands without a complete customer picture. This can result in disjointed marketing efforts and missed opportunities for engagement.

How to Choose a Retail Media Network For Media Partnerships

Choosing the right retail media network is a strategic decision akin to selecting the perfect storefront location; it’s about visibility, traffic, and the right fit for your brand.

To navigate this decision, follow these five steps to ensure your brand not only finds its spot in the digital limelight but also capitalizes on the unique opportunities that retail media networks offer:

1. Start With a Clear Plan and Matching Budget

It’s crucial to understand that retail media networks come with various price tags, mirroring the diversity in their reach and capabilities.

Your budget is a compass. Let it guide you to a retail media network that matches your financial constraints and aspirations. Scrutinize the strengths of your marketing team:

- Can they handle the demands of a high-traffic network

- Do they have the expertise to extract maximum value from sophisticated ad platforms?

Choose a retail media network that aligns with both your wallet and your workforce, ensuring that you’re investing in a network that’s not just affordable but also manageable. Look for options that offer scalability, allowing you to start modestly and expand your presence as your brand grows.

2. Consider Your Product Niche as a Guiding Factor

Investigate where similar brands cluster, and consider if your product’s features or pricing give it an edge in that space. You want your ad dollars to count, so pick a network where your product can shine — be it through competitive pricing or standout features.

Remember, context is key. For instance, if you’re selling pet supplies, your instinct might lean towards a pet-specific retail media network like PetCo, where the context is clear and the customer base is targeted. While general marketplaces like Wayfair also sell pet products, customers there might not have pet shopping as their primary intent. Align your choice with the retail media network that reflects your customer’s buying journey, ensuring that when customers think of your niche, your product is front and center in the right network.

3. Evaluate Their Service Offerings

Scrutinize the advertising options within each retail media network. Consider the digital ‘real estate’ your ad could inhabit: prime spots like home and category pages, the visibility in search results, or the connection on related product detail pages. Each of these placements offers a unique advantage akin to shelf positioning in a physical store.

The aim is to ensure your product is seen and considered. A retail media network that allows your ads to appear at these strategic points can significantly increase the chances of your product capturing consumer attention. Opt for a network that offers diverse and strategic ad placements that align with your brand’s vision and will likely influence the consumer’s path to purchase.

4. Consider Their Reach

Gauge the extent of the network’s reach carefully. A sprawling retail media network, like Amazon, offers a vast audience, but niche platforms may provide a more concentrated customer base better suited for specialized products.

Determine where your ideal customers are most prevalent. Are they lost in the enormity of a general marketplace, or are they browsing specialized sites? The goal is to position your product where it has the best chance of people finding and favoring it. Select a retail media network that has substantial traffic and the right kind of traffic. This decision should be like choosing a billboard location; it’s not just about the number of eyes but finding the eyes that will look with intent to buy.

5. Investigate The Tracking Capabilities Provided By Each Network

Delve into the analytical prowess of each retail media network. The value of an ad space is only as good as the insights it yields. Ask yourself:

- Does the network offer real-time analytics, allowing you to adjust campaigns dynamically?

- Are you provided with detailed reports that dissect every facet of your ad’s performance?

These tools are indispensable for understanding consumer behavior and measuring ROI. A retail media network with sophisticated tracking tools equips you with the data to refine your advertising strategies and pivot as necessary.

Opt for a network that doesn’t just place your ad but also arms you with the data to understand its journey — from impression to conversion — turning insights into action.

What Is a Data Clean Room, and How Does It Relate To Retail Media Networks?

A data clean room acts as a digital vault where retailers and advertisers can share data without compromising individual privacy. It’s the data equivalent of a masked ballroom dance; everyone can dance together, but no one knows the other’s true identity. In the context of Retail Media Networks, clean rooms are crucial. They allow for the exchange of anonymized, aggregated shopper information, enabling advertisers to understand consumer behaviors and tailor their campaigns without ever accessing personal details.

These clean rooms are pivotal because they balance the scales of data utility and privacy. They ensure that retailers can uphold consumer trust by protecting personal identities while still leveraging collective insights to drive sales and improve customer experiences. For brands, the distilled insights from clean rooms mean they can deploy precisely targeted ads that hit the mark, improving the chances of conversion without the privacy pitfalls.

At Habu, we’re reshaping how advertisers engage with the $45 billion retail media market. Our data clean room software, with seamless multi-cloud orchestration, unlocks a world of first-party data, ensuring secure, intelligent, and scalable insights. It’s our mission to enable you to navigate this market with precision, providing the insights you need to thrive.

Navigating The RMN Landscape

In the dynamic world of retail media networks, advertisers must navigate with confidence. Retail media networks offer access to valuable first-party data and hyper-targeted advertising. Yet, the intricacies of this landscape require careful consideration.

A data clean room, expertly provided by Habu, serves as a compass, ensuring privacy compliance while facilitating data collaboration. Discover insights to not only survive but thrive in the retail media network arena by reading our free e-book:

Frequently Asked Questions

We’ve covered a lot already, but imagine there are some lingering FAQs regarding retail media networks, so let’s dig into a few more common questions:

Why is a retail media network important?

A retail media network (RMN) holds significant importance in the modern advertising landscape, benefiting both advertisers and owners.

For advertisers, retail media networks offer a strategic solution to cut through the digital advertising noise. They enable precise audience targeting, increasing conversion rates and return on investment.

Owners find retail media networks invaluable for generating new revenue streams without resorting to steep price hikes. By tapping into the growing digital advertising market, retailers can diversify their income sources.

In a cluttered advertising landscape, retail media networks emerge as a beacon of precision and profitability. They empower advertisers to reach audiences effectively while enabling owners to bolster their revenue, making them a vital component of the advertising ecosystem.

What Is The Largest Retail Media Network By Revenue?

The largest retail media network by revenue is Amazon. In 2022, Amazon dominated the retail digital media spending landscape, commanding an impressive 76.9% share. This significant market share can be attributed to Amazon’s colossal customer base, with over 200 million Prime members in the United States alone.

Prime members are not only loyal but also highly engaged consumers, making Amazon’s advertising platform exceptionally attractive to advertisers. Additionally, Amazon’s extensive reach and diverse ecosystem of products and services further contribute to its dominance in the retail media network space, solidifying its position as the industry leader.

How Many Retail Media Networks Are There?

As of 2023, there are 150+ retail media networks operating in the digital advertising landscape. This substantial number highlights the rapid growth and diversification of this sector. Major players — like Amazon (Amazon Ads), Walmart (Walmart Connect), CVS (CVS Media Exchange), and Walgreens (Walgreens Advertising Group) — are among the prominent networks, but the ecosystem also includes numerous other retailers, both large and small, who have entered this dynamic space. The continually expanding pool of retail media networks reflects the evolving nature of digital advertising and the increasing significance of first-party data and targeted advertising in the retail industry.

How Big Is The Retail Media Network Ad Spend?

In 2022, the global digital retail media advertising expenditure soared to an estimated $114.4 billion, signifying the sector’s tremendous growth. Projections paint an even more impressive picture, with expectations that this figure will surge to over $176 billion by 2028.

To contextualize this colossal ad spend, consider Amazon’s remarkable performance in the same year. Amazon, as a single retail media network, generated an astounding $37.7 billion in worldwide ad sales in 2022. This illustrates the sheer scale and financial impact of retail media networks as they play a pivotal role in the evolving landscape of digital advertising and commerce.